This can result in a much higher turnover level, even if the company is no more profitable than its competitors. Third, a company may have chosen to outsource its production facilities, in which case it has a much lower asset base than its competitors. A services industry typically has a far smaller asset base, which makes the ratio less relevant. Second, the ratio is only useful in the more capital-intensive industries, usually involving the production of goods. Thus, a high turnover ratio does not necessarily result in more profits. First, it assumes that additional sales are good, when in reality the true measure of performance is the ability to generate a profit from sales.

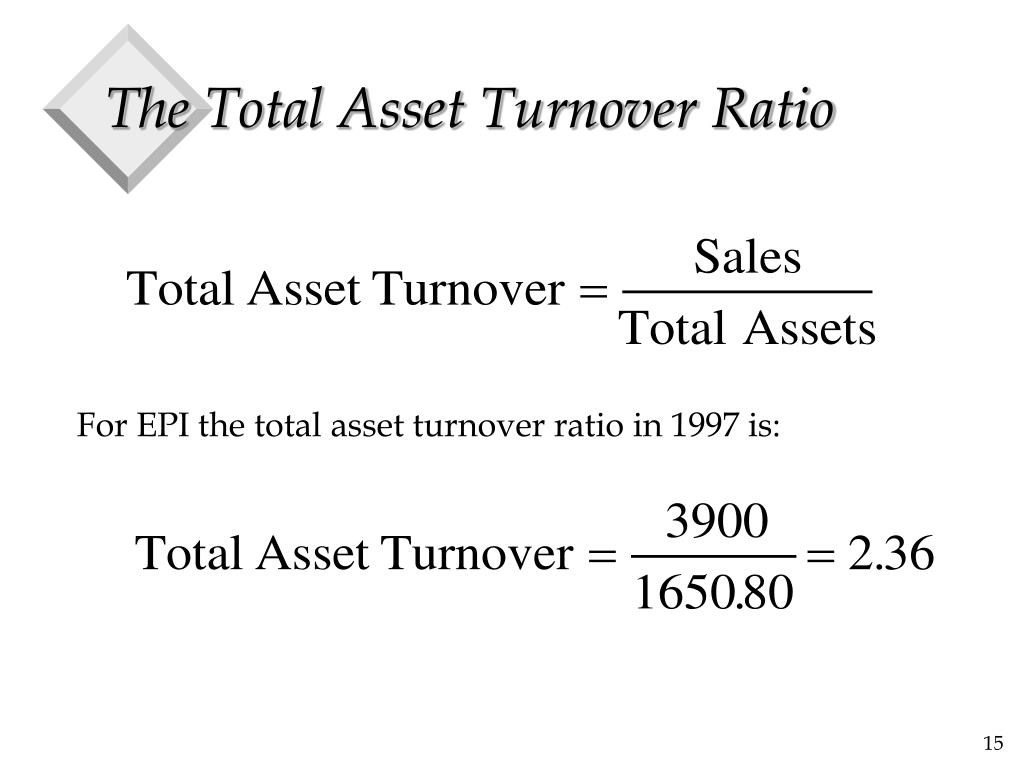

There are several problems with the ratio. Problems with the Total Asset Turnover Ratio This calculation is usually performed on an annual basis. Example of the Total Asset Turnover RatioĪ business that has net sales of $10,000,000 and total assets of $5,000,000 has a total asset turnover ratio of 2.0. Also, compare it to the same ratio for competitors, which can indicate which other companies are being more efficient in wringing more sales from their assets. It is best to plot the ratio on a trend line, to spot significant changes over time. Net sales ÷ Total assets = Total asset turnover The formula for total asset turnover can be derived from information on an entity’s income statement and balance sheet.

#Total asset turnover high or low how to#

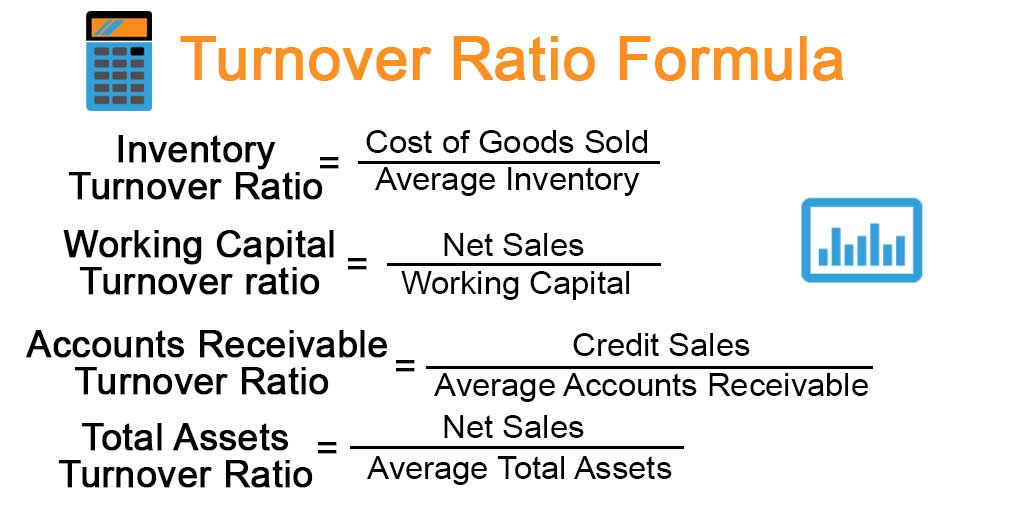

How to Calculate the Total Asset Turnover Ratio The result should be a comparatively greater return to its shareholders. Ideally, a company with a high total asset turnover ratio can operate with fewer assets than a less efficient competitor, and so requires less debt and equity to operate. The ratio measures the ability of an organization to efficiently produce sales, and is typically used by third parties to evaluate the operations of a business. Low-margin industries always tend to have a higher asset turnover ratio.The total asset turnover ratio compares the sales of a company to its asset base. Generally, a low asset turnover ratio suggests problems with surplus production capacity, poor inventory management and bad tax collection methods. The asset turnover ratio can be calculated by dividing the net sales value by the average of total assets.Īsset turnover = Net sales value/average of total assets DuPont analysis basically breaks down return on equity into three parts, asset turnover, profit margin and financial leverage. The asset turnover ratio is a key constituent of DuPont analysis, a method the DuPont Corporation began using at some point in the 1920s. Retail companies generally have small asset bases, but high sales volumes. According to a survey the retail sector scored an asset turnover ratio of 2.05 in 2014. For example, the retail sector yields the highest asset turnover ratio. The ratio can be higher for companies in certain sectors than others. Usually, it is calculated on an annual basis for a specific financial year.ĭescription: Asset turnover ratio can be calculated by considering the average of the assets held by a company at the beginning of the year and at the end of a financial year and keeping the total number of assets as the denominator. Asset turnover ratio can be different from company to company. The higher the ratio, the better is the company’s performance. Thus, asset turnover ratio can be a determinant of a company’s performance. It is an indicator of the efficiency with which a company is deploying its assets to produce the revenue. Definition: Asset turnover ratio is the ratio between the value of a company’s sales or revenues and the value of its assets.

0 kommentar(er)

0 kommentar(er)